網頁已經閒置了一段時間,為確保不會錯過最新的內容。請重新載入頁面。立即重新載入

查看更多「香港好去處」精彩內容

篩選結果: 334隻

| 代號 | 名稱 | 各階段回報 | 1個月回報 | 3個月回報 | 6個月回報 | 1年回報 | 3年回報 | 回報評分 | |

| 09008 | 博時比特幣-U | -4.24% | -23.44% | -19.57% | -6.73% | -- | 0.772 | ||

| 09009 | 博時以太幣-U | -2.70% | -25.58% | +17.07% | -14.79% | -- | 0.074 | ||

| 09010 | 安碩亞洲除日-U 創1個月高 | +2.02% | +3.47% | +15.33% | +30.73% | +57.25% | 7.463 | ||

| 09011 | A工銀中金美-U | +0.41% | +1.04% | +2.11% | +4.36% | +16.00% | 2.353 | ||

| 09040 | GX中國-U | +1.57% | -3.54% | +11.58% | +30.44% | -- | 7.426 | ||

| 09042 | 華夏比特幣-U | -3.80% | -23.77% | -19.65% | -6.69% | -- | 0.809 | ||

| 09046 | 華夏以太幣-U | -2.29% | -29.89% | +17.59% | -12.84% | -- | 0.294 | ||

| 09047 | F山證鐵礦石-U | +2.45% | +0.26% | +15.59% | +10.95% | +45.54% | 3.493 | ||

| 09064 | GX亞太-U | +2.80% | +9.70% | +15.20% | -- | -- | -- | ||

| 09067 | 安碩恒生科技-U | -0.27% | -13.83% | +6.65% | +25.77% | +38.22% | 6.140 | ||

| 09069 | 華夏恒生生科-U 創1個月低 | -8.64% | -18.56% | +8.90% | +66.97% | +8.08% | 9.706 | ||

| 09070 | 平安香港高息-U | -1.93% | +7.83% | +9.45% | +28.10% | -- | 6.912 | ||

| 09072 | 奧明環球聯網-U | -1.56% | -1.56% | +17.33% | +40.82% | +135.97% | 8.934 | ||

| 09074 | 安碩MS台灣-U | +3.90% | +6.69% | +18.95% | +32.14% | +120.18% | 7.684 | ||

| 09075 | GX亞洲美債-U | +0.43% | +0.68% | +5.48% | +5.42% | -- | 2.757 | ||

| 09077 | PP美國庫-U | +0.46% | +1.01% | +2.19% | +4.04% | +17.51% | 2.059 | ||

| 09078 | PP美國庫A-U | +0.30% | +1.45% | +2.10% | +4.56% | +15.87% | 2.500 | ||

| 09081 | 價值黃金-U | +7.49% | +13.60% | +32.80% | +66.46% | +139.35% | 9.669 | ||

| 09084 | AGX印度-U | -3.32% | -3.32% | -6.63% | -- | -- | -- | ||

| 09086 | 華夏納指-U | +4.49% | +3.77% | +13.62% | +21.84% | +131.36% | 5.110 |

更多篩選

一年風險率以過往一年數據計算的標準差來衡量投資回報的穩定性。

- 標準差越大:回報偏離平均值越多,風險越高

- 標準差越小:回報越穩定,風險越低

啤打系數(Beta)用於比較個股升跌與大市的關係。啤打系數越高,波幅越大;啤打系數越低,波幅越穩定。

= 1:股票升跌與大市同步。

> 1:股票波幅大於大市。

< 1:股票波幅小於大市。

< 0:股票波幅與大市相反。

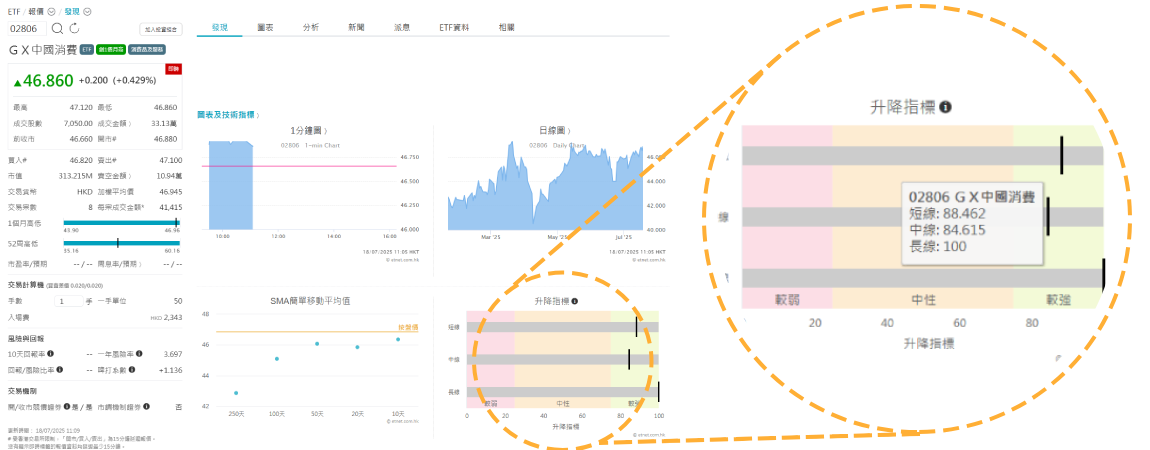

升降指標用來分析股票走勢,透過比較股票的按盤價和多條簡單移動平均線(SMA)。

< 25:趨勢較疲弱

25 ~ 75:處於中性,沒有明顯的方向

> 75:趨勢較強

短線升降指標:按盤價對比10天,20及50天簡單移動平均線

中線升降指標:按盤價對比20天,50及100天簡單移動平均線

長線升降指標:按盤價對比50天,100及250天簡單移動平均線

*無成交時,則無升降指標數據顯示。

報價延遲最少15分鐘,更新:31/12/2025 17:59

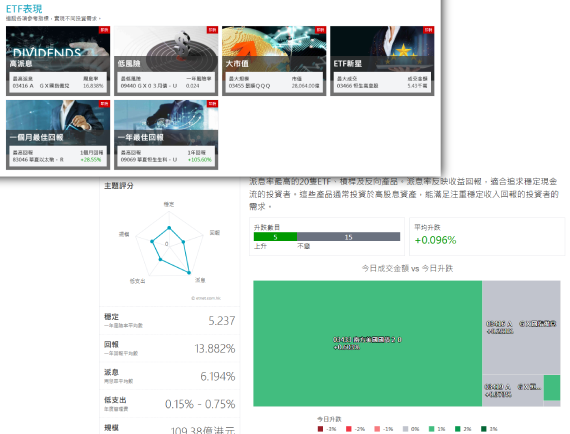

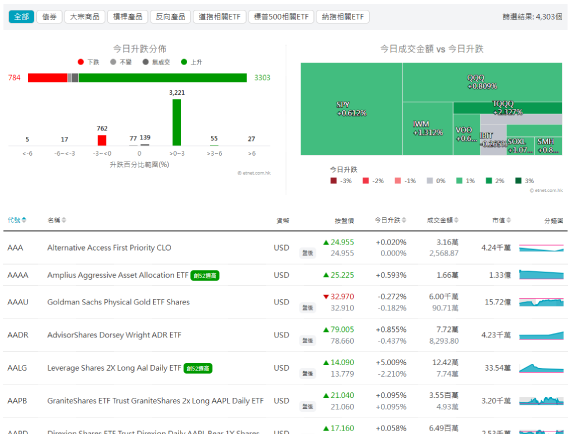

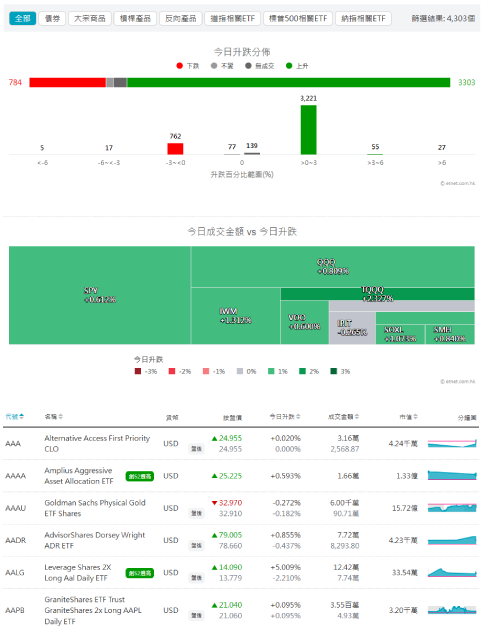

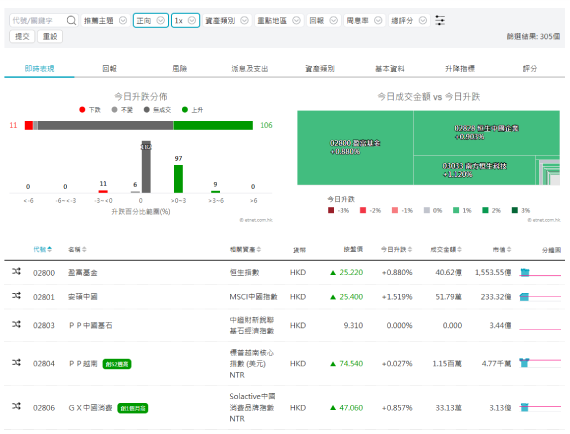

宏觀ETF市場動態,從大市到投資主題表現,快速掌握投資佈局

從當日走勢到長期佈局,動態解讀,指引投資方向

同步美股ETF動向,追蹤跨市場趨勢

從當日走勢到長期佈局,動態解讀,指引投資方向

同步美股ETF動向,追蹤跨市場趨勢

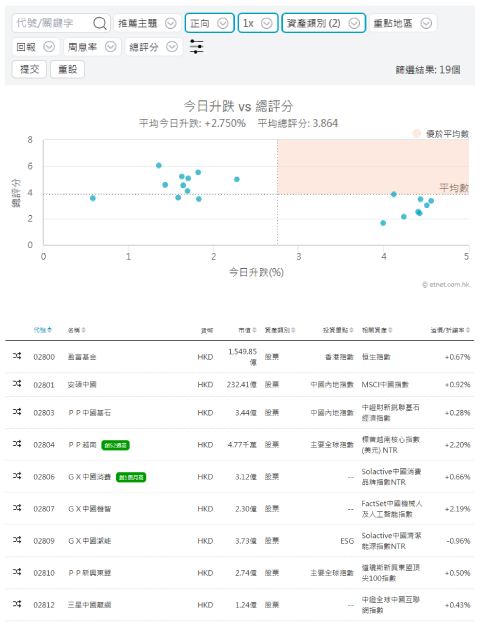

多維度篩選工具,配合圖像化分析,快速鎖定目標ETF

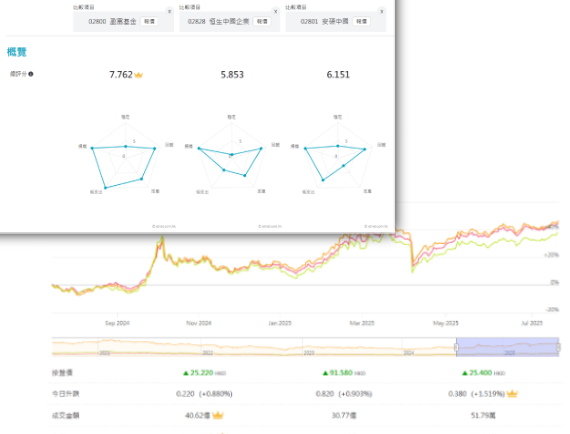

一Click即比較,快速對比關鍵指標,綜合評分一目了然

多維度篩選工具,配合圖像化分析,快速鎖定目標ETF

一Click即比較,快速對比關鍵指標,綜合評分一目了然

實時分析價格走勢,捕捉入市信號

實時分析價格走勢,捕捉入市信號